Best way to invest money: 3 steps you wish you knew at 20

The journey towards financial wisdom is a painful one, mostly. It involves exploring various available forms of investing, then deciding which ones are worth your time and money, then learning as much as you can about them and finally trying them out. Oh, and the “most enjoyable” last step in the process of establishing the best way to invest money – all the money lost whilst testing and learning, failing mostly, making all kinds of bad (but considered good at the time) decisions. But this is all good – it builds up your financial savvy. This takes years if not decades – for an average income person – the more money you have available, the faster this process is, but we’ll focus on the majority here – people, who can save some money monthly, but are no tycoons with properties and capital.

There’s also another way to achieve the same result, less the years of trying and the losses – learning from people, who went through the process and share their knowledge.

In this post, we will do just that: I’ll share my journey and findings and we will look at the most famous investors and what they do for their financial freedom.

You’ll be surprised how simple the solution is and you will wish you started doing it as soon as you had your first paid job. But if the best time was years ago, the second best time is right now.

What is the best way to invest money?

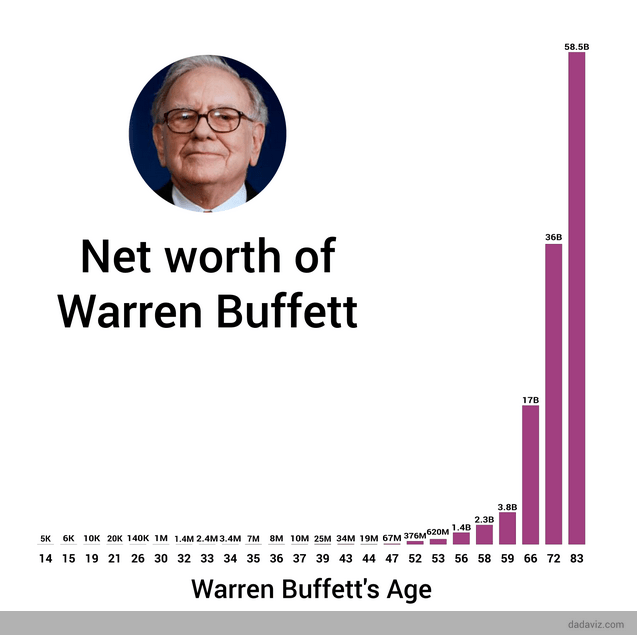

Since you’re interested in this topic, you have probably heard of Warren Buffett – one of the most renowned and successful investors out there (and therefore one of the richest too). He was worth around $82 billion as of July 2019. For most people, that’s fairy tale money – we’ll be happy and sorted with about 1 million in savings (also depends where you live, but this will do in most parts of the world).

You know what’s most interesting? Warren Buffett’s billions didn’t happen until he was 55 years old. His first million came around the age of 30. Only four years before that, at age 26, he was worth around $140,000 – which is achievable today for anyone with a good enough job and stable savings & investing habit (which this whole post is about). You’ll see it nicely on this chart:

Key facts to note about Warren Buffett:

- He started investing very early – at 11 years old

- He worked hard (delivering newspapers and at least four other ventures) and invested most of it

- At age 16, he already amassed a wealth of $6000 (in today’s money around $80,000) (same article as above) – meaning he really had a head start – but nothing you can’t start today

- yet 99% of his wealth came after his 50th birthday and now can make $37 million per day – very likely just passive income (interest and stock appreciation) – meaning it still took gradual and slow investments over longer time to grow his riches

- His worth only really grew by 20% annually – meaning he didn’t have any magic trick or huge luck. The US market (S&P500) grew by about 10% in the last 100 years. So he did much better than that. But even if we start today and get 10%, we can follow a similar curve as he did. Not towards billions, but hundreds of thousands or millions. And your priorities and values might need some re-thinking if that’s not enough for you.

Potential outliers that we might not encounter (that helped Warren Buffett)

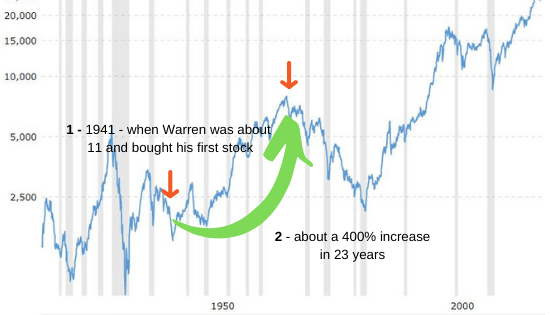

- buying his first stock in 1941 (1) and investing his $6000 in 1946 had different opportunities than we have today – the stock market was a new thing and grew much faster (it had it’s bad moments too, but nevertheless, it grew faster than today)

- since his first investment, the market grew 400% (2)

- he was doing it in the much more free-market (incl. regulations) in the US, compared to what we have today

I mention these to highlight that it’s never a good idea to take another person’s success as a written rule (“if you follow the same steps, the same will happen”). You never know their circumstances, their environment and possibilities (inherent or found). Just take what’s good, and apply it in your circumstances.

Key learning from Warren Buffett’s story

It takes gradual and constant effort (investments) for a long period of time for your investments to grow into riches. The sooner you start – the better.

His quote sums it up nicely:

Someone’s sitting in the shade today because someone planted a tree a long time ago.

Warren Buffett

How NOT to invest money

I started playing around (that’s the correct wording, as I was very new to it) with investments around 12 years ago. Slow start – just reading books, forums, checking various forms of investing with smaller amounts of money. After a few years of this, I started to invest in a more serious way – quit my job and started actively buying and trading stocks, later forex, copy-trading and ended up with ETFs and regular investments into dividend stocks.

I earned some money and I lost some money on this journey – and by summarising it here, I want to save you the trouble and money in trying out all the incorrect ways to invest money. Overall, within 6 years of active investing, including long term positions, I am close to zero profit on most of my early investments (still profitable, but not worth the effort – only if for the knowledge). Which is not bad for some types of investments. I am nevertheless much wiser and seeing a regular and much more stable return on my later investments today – which I am recommending to you in this article.

But first – here are the ones I tried and do not recommend:

- Forex (foreign exchange market) – this one is a black hole for investments. It’s not an investment, it’s speculation at best, that mostly (various sources quote 77%, 80% or 96% of currency traders end up losing their money – whichever way you look at it, you are very likely you will lose your money and it is a very stressful endeavour. In short – you need to master your psychology and not interfere with your trades if they go the wrong way, set your stop losses and take profits with mathematical precision, follow the market, news and political development. And yet – never know what will happen, as the market and currency pairs can be influenced by anything from the cost of oil barrels, through wheat and other commodities, political situation, weather, fires, civil unrest and much more. And if you believe in technical analysis of patterns in charts, you might as well believe in telling fortune from patterns at the bottom of coffee mugs. Academics call technical analysis “pseudoscientific nonsense” – there might be some use to it, but at best, it’s a mixed bag. And you don’t want to risk your money daily on a mixed bag.

- Copy-trading – instead of making your own trades, you select other traders and let the system automatically copy their trades with your money. Apparently, copy-trading can give you another 6-10% advantage (higher success rate), than trading yourself. My experience over a two year period wasn’t too different from trading myself – instead of having to follow the currency pairs, you still have to follow the performance of the traders you’ve chosen. They are human and more often than not make mistakes, or are swayed by various incentives they get from acquiring more followers (i.e. their trades might not be their main source of income and therefore might not be the best trades out there). Instead of only having to account for your human factor, you introduce the human factor of all the copy traders – which more often than not, ends up in you losing out.

- Active stock trading – that is actively buying and selling stocks based on analysis of their fundamentals and market sentiment on a daily or monthly basis. (you buy and sell within a period shorter than a year, usually days or weeks, sometimes months). I think you can see better returns here than with Forex, but it’s still too unstable and risky. Plus you have to follow the development of each stock you trade, the market situation and your trades. This isn’t how long term wealth is made, also not how long term happiness and peace is achieved.

There are some other candidates that might be worth trying out, but they are not purely investments – more businesses:

- property investment – you buy and sell later or you buy and rent. Can work, isn’t the worst choice (certainly better than the ones listed in How NOT to invest section above), but you might need to run it as a business plus, it requires a higher capital upfront.

- building your own business and scaling it up – an e-shop, a website that lives off advertising and affiliates or selling a service. All might be worth it and if you do the right things, might be scaled to become a good way to spend your time and money. But this is a whole other topic – how to build a business, not how to invest. You can find lots of useful information about building an online business on Ebizfacts.com.

Three steps to invest your money wisely

Based on what we learned about Warren Buffett and from my experience, I see these steps as the safest and most reliable way to invest and grow your capital.

Step 1 – do whatever you can to raise your income and lower your costs

Just like Warren Buffett – to grow capital, you have to have some first. The more you can invest today and the more you can contribute regularly and consistently over longer period of time (10-20 years), the bigger your capital will become. Don’t just lower your costs or just increase your income. Do both at the same time and you’ll be able to save & invest a much bigger chunk.

I really wish they taught me this at school instead of poems or GDP of each country in the world.

- Start by finding a way to measure how much you spend and earn every month. I use Monefy to track all my everyday spending, then I write it into a monthly spreadsheet, together with my monthly income. That way, I know whether my monthly costs are going up or down and where are the problem areas – what to do to lower my costs and increase my income. You have to measure your personal financials like a business if you want to take control.

Step 2 – set up a regular and automated way to save a specific amount each month

Regular and automated is the key here – don’t leave it to your memory, set up an automatic transfer of a certain amount you want to put away monthly from your main account to a savings account. Then in less frequent intervals, say quarterly, transfer this amount into a good investment portfolio (see below). All good banks will let you set up this form of automated saving – a specific amount, or rounding up of every transaction or a % of every transaction. The logistics don’t matter, the regularity does.

Putting away $300 each month gives you $3600 to invest annually. This can grow to $50,000 in 10 years with a 5% compound interest rate. If I did this when I was 20, I’d be sitting on about $350,000 of capital. This would turn into my first million by age 55 and 2 million by age 60. Talk about DIY retirement!

You can play around with these figures in this Moneychimp CalculatorTry the calculator with whatever amount you think you can save monthly/yearly and over at least 10 years. Investing and growing your capital is (along the lines of sensimism), like anything in nature – it requires time, constant and gradual effort. Don’t try to hack it, you’ll mostly end up losing money.

Step 3 – invest saved money in regular intervals into a safe enough investment with compound interest

Now that you have saved enough money to invest and you will do so regularly in the future, you need to put it somewhere safe enough, where it will appreciate.

- Ignore all 1%-3% saving accounts that are limited to say $3000 max per year. They are a nice marketing tool, but will not grow your capital much precisely because of the maximum amount cap

- stay away from anything that promises great return with no risk – there’s no such thing. Every investment carries some level of risk. The ones we mentioned in “How NOT to invest money” section carry too much risk. Don’t put your capital in them

- from all I learned and experienced, dividend stock investing is so far the safest way, and most accessible. This deserves a whole new article, but most important facts are:

- with dividend stocks, you get paid a regular dividend regardless of the performance of the stock. In other words, whether the price of the stock goes up or down, you will get paid a dividend. Usually around 4% (depends on the stocks you choose)

- if you choose the right stocks (see fundamental analysis and how Warren Buffett chooses his stocks). I use free sources like www.seekingalpha.com, www.finviz.com and www.tipranks.com to get all the information I need.

- I have also prepared a FREE DIVIDEND METER template you can use to get a lot of information automatically using Google database to help you validate them

- the idea is to pick stocks that are long term stable (have been growing or stable for 10+ years), offer a good dividend yield (3-4%) even better if it’s growing over time. This way your stock value should grow as well as your dividend yield + regular paid out dividend will be re-invested into these stocks. This creates a three-fold approach of growing your capital (stock growth, dividend growth, reinvested dividend income), which will speed up the whole process compared to just receiving a set interest or just stock growth

- Jason Fieber has written a good, concise summary of how to find and invest in the right dividend stocks

- Diversify your portfolio – don’t put more than 3-4% of the total portfolio into a single stock. That way, even if this company goes bust for some reason, it will not impact your overall portfolio too much and it will not eliminate your total gains. For example, if you invest say $50,000 over some time, $1500 (3% of $50,000) should be invested in one single company. This way, you’d need to invest into at least 33 companies. Find a number that’s not too high to control (it’s hard to monitor the progress of 100+ companies) and not too low to increase your risk (anything below 20).

- You can open an account to buy dividend stocks with a reputable broker, I have very good experience with Charles Schwab – this year they even dropped transaction fees.)

- other worthy mentions are ETFs or Index funds – just be careful about their annual charges (some have high charges that could wipe out your compound interest). Some of them pay dividends too, some don’t. They are much safer than buying individual stocks if you don’t want to spend time analysing each stock separately. But you still need to analyse these funds, the upside being, you don’t need to have so many of them.

That’s it – start doing step 1 and set up step 2 today and repeat step 3 regularly until you are happy with your portfolio size and decide to stop, or you will be able to live off your regular dividends, once your portfolio grows big enough. For example, a 4% dividend yield on a $300,000 portfolio can give you a regular monthly and passive income of $1000 per month. Again, let’s go back to earlier example on myself – if I started when I was 20years old, today I would have around $350,000 and therefore could live without having to work already today. Early retirement at 35, not bad.

If you teach this to your children, you will give them the best gift and skill for life ever. If you can start it now and still have 30+ years to live, don’t put it off another day.

Conclusion

The best way to invest money is nothing complicated – no complex schemes, convoluted borrowing and lending, it’s good old disciplined money-saving in regular intervals, with the added bonus of investing it wisely into a good combination of compound interest and dividends that good dividend stocks provide.

- Stop chasing get-rich-quick schemes and promises.

- Start saving and investing regularly today, even in small amounts.

- Reduce your costs and increase your income as much as you can.

- Open an account at a good broker (I have very good experience with Charles Schwab) and start buying well-performing and stable dividend stocks.

- Learn about fundamental analysis and how to choose the right dividend stocks by reading these recommended books: